Are you tired of the stress and hassle of paper submissions when filing IRS Form 4868? The good news is that with iFax, you can fax forms electronically and avoid all the headaches associated with paper submissions.

In this blog post, we’ll show you how to file your IRS Form 4868 with iFax and why you should consider switching to electronic filing. From the convenience of submitting your form from the comfort of your home to digital record keeping, electronic filing with iFax offers numerous benefits. So, let’s get started and discover how to make your tax season a breeze.

Overview of IRS Extension Form 4868

Overview of IRS Extension Form 4868

The IRS (Internal Revenue Service) Form 4868 pertains to a tax extension request for filing your federal income tax return. This form gives individuals and businesses an additional six months to file their taxes, which can be helpful for those needing more time to gather all the necessary information and documents.

Due date

The due date for IRS Tax Form 4868 is typically April 15th, the same day your federal income tax return is due. However, the due date may vary if you request an extension for your business.

Where to file

You can file IRS Form 4868 either electronically or by mail. If you file electronically, you can use a service like iFax to submit your form. If you prefer to file by mail, you can send your document to the address listed on the record, which you can find on the IRS website.

Who can file

Anyone required to file a federal income tax return can file IRS Tax Form 4868. The list includes individuals, businesses, and estates. Depending on your situation, it could be possible to enlist a qualified representative to file the document for you.

How to Fax Form 4868

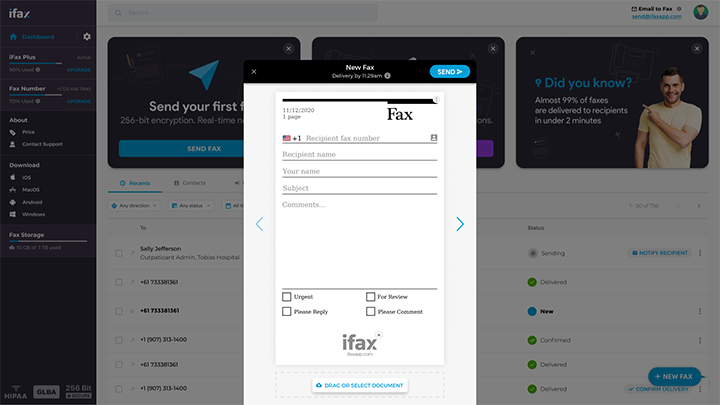

When online faxing IRS Form 4868, there are several steps you’ll have to follow. Here’s a step-by-step guide on how to file your tax extension request with iFax:

- Gather all the necessary information and fill out the IRS Extension Form 4868. You can download the document from the IRS website or request it from a tax professional.

- Next, sign and date the form to ensure it is valid. You may use an eSignature app like Fill to create and affix your electronic signature within minutes.

- Export and download the file as a PDF to prepare it for online faxing.

- Once you have the document ready, log in to your iFax account and upload the digital copy of your form by creating a new fax.

- Fill out the necessary details, including the specific fax number you’ll have to obtain from the IRS.

- Once you’ve uploaded the form, hit the send button to transmit the form to the IRS.

- iFax will notify you through email when the IRS has received your Form 4868.

That’s it! With iFax, you can file your IRS Form 4868 in minutes. No need to worry about paper submissions or postage costs. Plus, you’ll have a digital copy of your form for your records.

Why You Should Use iFax For Filing IRS Form 4868

Convenience

With iFax, you can file your IRS Form 4868 from the comfort of your home without going to a tax professional or the post office.Time-saving

Filing IRS Form 4868 electronically with iFax saves you time compared to traditional paper submissions, as you can transmit the form in just a few minutes.Accurate submissions

iFax ensures that your form is transmitted accurately and securely, reducing the chances of errors and rejections.Digital copy

Fax provides a digital copy of your form, making it easy to access and store for your records anytime and anywhere.Affordable

With iFax, you can file your tax extension request cheaper than traditional paper submissions, as there are no postage or printing costs.Use iFax to File Your Tax Extension Request

As we’ve shown, filing IRS Form 4868 electronically with iFax offers numerous benefits compared to traditional methods. From proven convenience to valid and protected transmissions, iFax makes it easy to request an extension on your federal income tax return.

By switching to iFax, you can save time and money and reduce the stress associated with tax season. If you need more time to gather your information and file your taxes, consider online faxing IRS Form 4868 with iFax today. It’s the best decision you can make today.

Don’t wait until the deadline to submit your documents to the IRS. You can start free now and experience the convenience of online faxing Form 4868.

Overview of IRS Extension Form 4868

Overview of IRS Extension Form 4868