Are you a small business looking to file for S Corporation status with the IRS? Filing tax Form 2553 can be tedious, but with the help of iFax, you can do it quickly and securely.

In this article, we’ll guide you through how to file Form 2553 via iFax, a convenient online fax service. Say goodbye to the hassle of printing, mailing, and lost forms, and enjoy the benefits of S Corporation status with ease.

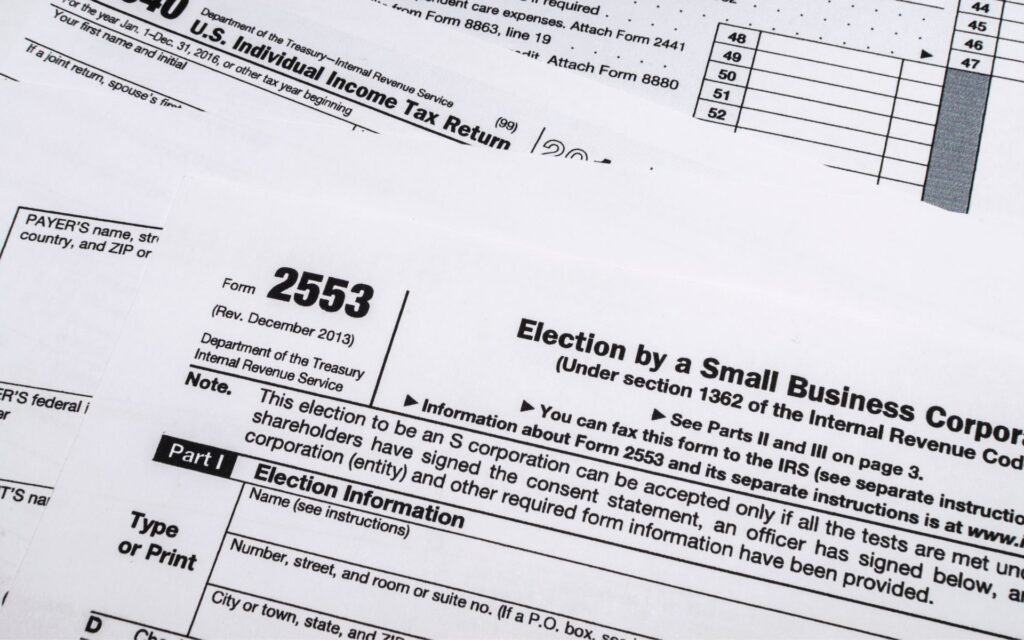

What is IRS Form 2553?

What is IRS Form 2553?

Form 2553 is an official document used by the Internal Revenue Service (IRS) to recognize a small business as an S Corporation. By submitting this form, qualified S Corporations can enjoy various tax benefits, including the ability to pass on business income, deductions, and credits to their shareholders.

Who Needs to File an IRS Form 2553?

S Corporations, including newly formed businesses and existing corporations, must file Form 2553 to elect S Corporation tax status with the IRS. These businesses must file the form within two months and 15 days of the beginning of the tax year for which the election is to be effective.

Eligibility Requirements for Filing Tax Form 2553

Any business must meet specific criteria to be eligible for S Corporation status. These standards include the following:- Be a domestic corporation

- Have only allowable shareholders, which include individuals, certain trusts, and estates

- Not more than 100 shareholders

- Not be an investment company

- Use a calendar year as its tax year

- Not have non-resident alien shareholders

Information You Need For Online Faxing IRS Form 2553

When a business corporation decides to elect for S corporation status, they must complete IRS Form 2553 and submit it to the IRS. Here are the necessary details you need to fill in the form correctly. Make sure to have these secured before you proceed with submission.

- Business name, address, and employer identification number (EIN)

- Names and addresses of all shareholders

- Signature of an officer authorized to sign for the corporation

- Target election date

- The tax year for which the election is effective

How to File Form 2553 Via Online Fax

You can file Form 2553 in the following ways:

- Electronically using the IRS e-file system

- By mail to the address specified in the instructions

- Online faxing

For businesses that prefer a more convenient and secure option, online faxing is also an option for submitting Form 2553 to the IRS. Using a reliable online fax service, such as iFax, businesses can easily send the form directly to the IRS without the hassle of printing, mailing, or dealing with lost or delayed tax documents.

Plus, online faxing helps ensure the confidentiality and security of sensitive information. Here’s how to file Form 2553 with iFax for tax purposes.

Sending Form 2553 via fax

- Prepare your Form 2553. You may download this file from the IRS website or request a copy from a tax professional.

- Next, fill out your form and ensure it is complete and accurate, including signatures from authorized officers. It would be best to use a dedicated eSignature app like Fill to edit and sign the form.

- Once your document is ready, go to the iFax website and sign up for an account by entering your email address and creating a password. You may log in if you have an existing account.

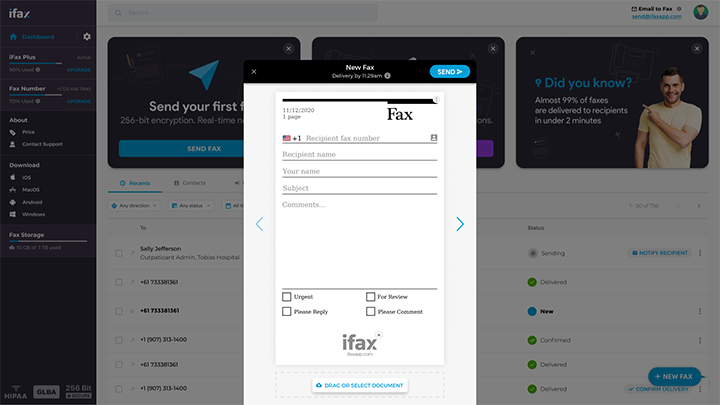

- On the iFax dashboard, click the “New Fax” button in the bottom right corner. A new window will appear, prompting you to fill out several details.

- Enter the fax number of the IRS office where you need to send your Form 2553. You can often find the fax number in the instructions for the form. Otherwise, you’ll have to do some sleuthing.

- Next, add an attachment and select your form’s accomplished electronic version. The file should be in PDF for maximum compatibility.

- Once everything’s in place, click the Send button to transmit your Form 2553 to the IRS.

- iFax will notify you through email once your fax has reached the IRS. You can also track the status of your fax in your iFax account.

Using iFax, filing Form 2553 with the IRS has never been easier. Our online fax service offers a convenient and secure solution for small businesses to file their S Corporation election without the long steps you’ll encounter using other methods.

Use iFax For Online Faxing IRS Form 2553

As you’ve learned, filing tax Form 2553 is essential for small businesses to enjoy the benefits of an S Corporation. With the convenience and security of online faxing, using a service like iFax makes the process quick and hassle-free.

For all your tax filing needs, look no further than iFax. Its enterprise-friendly feature set and affordable pricing make managing finances easy .Exploring free fax options can help you understand how iFax can streamline your tax filing process.

Sign up for an iFax account today and enjoy a free trial to experience a better way to handle forms

What is IRS Form 2553?

What is IRS Form 2553?