Tax season can be an overwhelming time for both businesses and individuals. The complexity of tax laws and regulations, combined with the need to provide accurate information promptly, can cause stress and anxiety to many.

Despite all the difficulties, you must remember that properly filing and submitting tax forms is your legal obligation. Failure to do so can result in penalties and other consequences. The good news is there are a lot of resources that can help you navigate this process. In this article, we’ll teach you how to file Form SS-4 by phone, email, and online fax.

Table of Contents

What Is Form SS-4?

One of the major requirements when starting a new business in the US is an Employer Identification Number (EIN). It’s a unique nine-digit number used to identify a business entity for tax purposes. An EIN is necessary to open business bank accounts, hire and pay employees, and conduct business transactions.

To get your own EIN, you will need to fill out a tax form called Form SS-4 and submit it to the Internal Revenue Service (IRS). This form asks for some basic information, including the nature of your business and its key individuals or authorized representatives.

Obtaining an EIN through filing Form SS-4 is not exclusive to businesses. In addition to employers, here are other entities that also need to file this tax form:

- Sole proprietorships

- Partnerships

- Corporations

- Limited Liability Companies (LLCs)

- Estates of decedents and trusts

- Trusts

- Non-profit organizations

How to Prepare Form SS-4

Before we teach you how to file Form SS-4, let’s first look at some of the preparations you need to make.

- Determine your eligibility to apply for an EIN.

- Obtain a copy of Form SS-4. You can download a copy of the form from the IRS website.

- Gather the necessary information, like your name, address, tax classification, and the name and SSN or ITIN of the responsible party.

- Choose the method to apply for the EIN. You can do it online, by fax, mail, or telephone.

- Complete the form by providing the required information in the appropriate fields.

- Verify the accuracy of the information provided on the form.

- Sign and submit the form to the IRS.

It is crucial to be precise and accurate when filling out Form SS-4. Errors or omissions can result in delays in processing or rejection of the application. Take your time and seek professional assistance if necessary.

Filling Out Form SS-4: A Quick Walkthrough

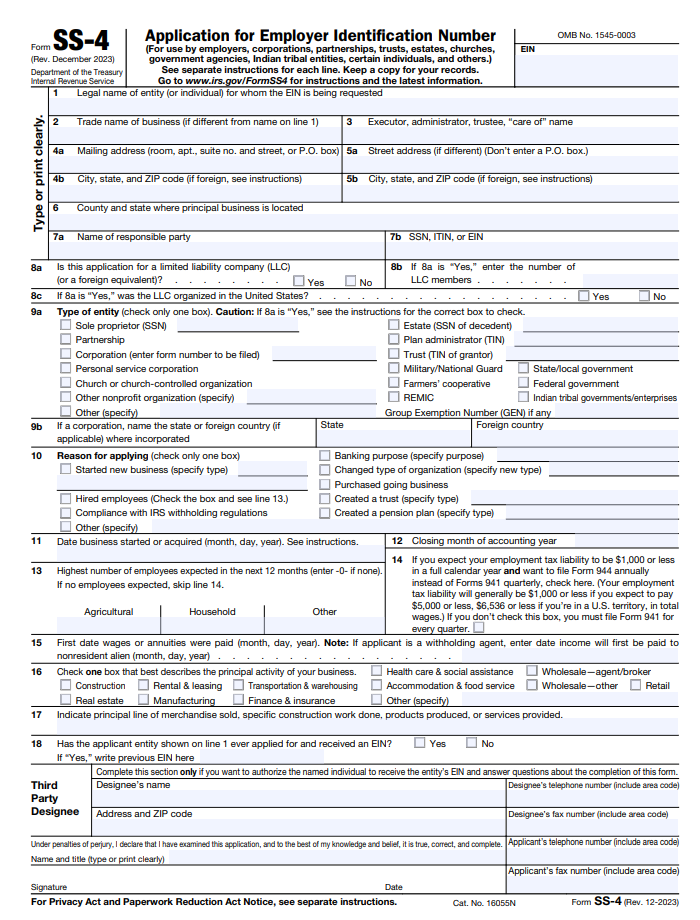

Form SS-4 is composed of three major sections. You need to fill each of these sections accurately to ensure that your application for EIN goes as smoothly as possible.

General information

In this section, you will need to enter the following data:

- The legal name of your business

- Your trade name or DBA if it’s different from your legal name

- The physical and mailing address of your business

- Your responsible party’s basic information, including their full name and Social Security number

Business type information

Here you will add more details about your business. You need to indicate whether it’s an LLC or not. Moreover, you have to identify the type of entity your business is, whether it’s sole proprietor, corporation, etc.

Other business information

To complete your Form SS-4, you must also provide additional information about your business, including:

- The reason you’re applying for an EIN

- The date your business started

- The closing month of your business’s fiscal or accounting year

- The highest number of employees you are expecting

- The first date your business paid salaries or annuities

- The primary activity or industry of your business

- A more detailed description of your business’s primary activities

How to File Form SS-4

At first glance, learning how to file Form SS-4 can look intimidating, but with the right information and tools, it can be quite a straightforward process. There are four ways you can go about it.

Online

- Visit the IRS’s website and access the EIN Assistant page to begin the process.

- Complete the online questionnaire. The questionnaire will determine if you are eligible to apply for an EIN online.

- If you are eligible to apply online, you can proceed to fill out the online application form. You will be able to fill out the online application. Make sure to provide accurate and correct information.

- After filling out the online application, submit it to the IRS.

- You will receive your EIN from the IRS within 1-2 weeks of submitting the online application.

- Download the form from the IRS website.

- Fill out the form with the necessary information. Again, be sure to put the correct data.

- Mail the completed Form SS-4 to the following address:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

It takes around four weeks for you to receive your EIN.

Phone

- Call the Business & Specialty Tax Line. Dial (800) 829-4933 to reach the Business & Specialty Tax Line.

- The operator will ask you to provide some basic information about your business or organization. Answer truthfully and completely.

- Once your application is granted, you will receive your EIN before the end of the phone call.

Fax

- Obtain a copy of Form SS-4. Go to the IRS website and download a copy of the form.

- Duly accomplish the form. Fill it out accurately and completely, making sure to provide all the required information.

- Fax the completed form to the IRS at (855) 641-6935.

- You will receive your EIN from the IRS within four business days of submitting the faxed form.

The IRS provides detailed instructions and guidance on its website to help taxpayers understand the process and file their tax forms accurately.

File Your Form SS-4 With Ease Using iFax

With iFax, you can file your Form SS-4 from the comfort of your own home or office. Say goodbye to long lines, slow processing times, and expensive fees. iFax allows you to file your Form SS-4 online, from anywhere, and at any time. Best of all, you don’t have to wait long to receive your EIN.

iFax is a secure and reliable platform that makes filing your tax forms quick and effortless. Simply complete the form, attach it to the fax, and send it directly to the Internal Revenue Service (IRS) with just a few clicks. With iFax, you don’t have to experience the stress and frustration of traditional filing methods.

We offer flexible pricing plans that’ll suit your faxing needs and budget. So what are you waiting for? Get started with iFax today and experience the simplicity of filing forms via online faxing.