Businesses rely on online bookkeeping software to monitor finances and handle taxes. But of course, human accountants are still more equipped and reliable than AI-powered accounting software. However, many enterprise owners still choose bookkeeping platforms to save time, money, and resources. QuickBooks is a great example.

A reputable bookkeeping software, QuickBooks has a user-friendly interface and comprehensive features. For instance, its Payments option lets you generate invoices and get instant payment confirmation. The question is, can you use it in a healthcare setting?

Learn more about QuickBooks HIPAA compliance and its importance.

Table of Contents

Is Quickbooks HIPAA Compliant?

No, QuickBooks is not HIPAA-compliant. While it employs security features online, healthcare professionals cannot trust it to meet stringent healthcare regulatory requirements, specifically for medical billing.

Medical providers should be careful not to enter patient invoices and payouts with protected health information (PHI) into QuickBooks. Using it to process or handle documents that contain patient demographic data and health conditions could put your organization at risk of non-compliance.

One of the Health Insurance Portability and Accountability Act (HIPAA) requirements is for third-party vendors to sign a Business Associate Agreement (BAA), which states the responsibilities of both parties to protect PHI. Therefore, storing PHI with Quickbooks is not advisable since it doesn’t enter into a BAA with its clients.

How to Ensure QuickBooks Compliance With HIPAA

While QuickBooks does not comply with HIPAA, medical companies can still use the software for specific administrative tasks.

Here’s how to ensure HIPAA compliance when using QuickBooks, considering its limitations when handling sensitive health information:

Avoid using Quickbooks for patient data management

If you still want to use QuickBooks, make sure you don’t input any PHI-related information into the software. To remain HIPAA-compliant, limit its use for the sole purpose of generating sales receipts and revenue except for patient data.

Have adequate data security in place

Before integrating the accounting software into your administrative workflow, strengthen your organization’s privacy and security measures first. This includes maintaining audit trails and setting appropriate user permissions. Audit logs can monitor login details and activities whenever someone views or enters protected health information into the accounting system.

Get a HIPAA-compliant hosting solution

If QuickBooks can’t provide the high-level security required by HIPAA, another option is to find a cloud-based hosting provider to make the app technically compliant. There are virtual systems that are secure enough to store all data via their own separate network. So, if you’re hosting its desktop application in the Cloud, make sure to choose a hosting solution that’ll sign a BAA and conduct regular auditing assessments.

Best Features of a HIPAA-Compliant Accounting Software

Below are some features to look out for in a HIPAA-compliant accounting and bookkeeping software:

User permissions

Make sure your software can define and restrict the roles of each user in your company. You should be able to set permissions restricting access and editing permissions of sensitive data to authorized personnel.

Audit trail management

Good accounting software provides an accurate and up-to-date audit trail. This way, you can see who among your members recently logged in, accessed, or modified your company’s financial or medical records and whether they’ve been given the authority to do so.

Data privacy and security

The most important feature to look out for in bookkeeping software is how it can protect confidential patient data. Choose an accounting platform with the highest level of encryption and robust access controls.

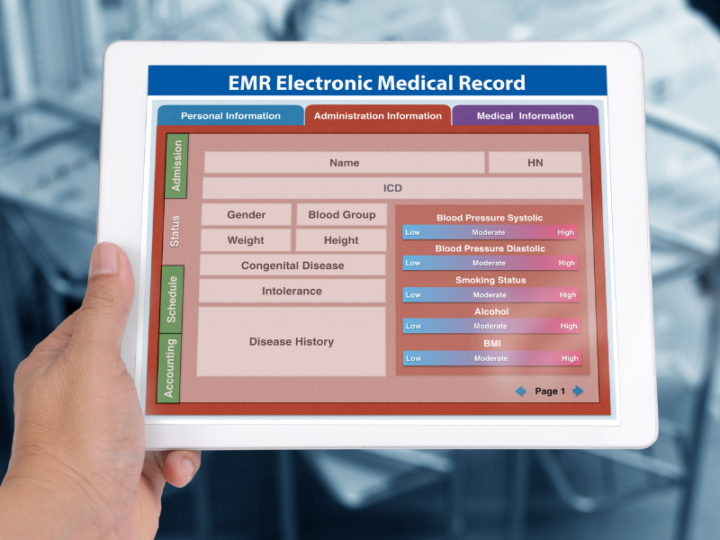

Seamless EMR and EHR integrations

A HIPAA-compliant accounting software must seamlessly integrate with your existing electronic medical record (EMR) and EHR systems. This makes PHI transfers from your EMR or EHR to your bookkeeping software secure and seamless.

Ease of access

On top of tight security features and compliance with regulatory standards, your bookkeeping software must be user-friendly and offer capabilities that you can use to your advantage. It should come with feature add-ons such as appointment scheduling and auto-billing.

Top Alternatives to QuickBooks for Healthcare Organizations

Since QuickBooks is not HIPAA-compliant, consider looking for other accounting platforms that ensure compliance with healthcare industry regulations.

Here are some of the best alternatives to QuickBooks:

Sage

Sage Intacct is a US-based financial management software for all businesses, including healthcare organizations. It offers services that enable you to monitor your operational metrics and ratios, such as revenue per treatment and available capacity. Moreover, it has an advanced audit trail function for tracking and recording all accounting-related activities.

Cliniko

Another alternative to QuickBooks is Cliniko, an allied health practice management software that provides booking, scheduling, and finance management. It is also HIPAA-compliant and implements industry-standard 256-bit encryption and a 2048-bit SSL certification for in-transit data. You can also request a BAA straight from your Cliniko account settings.

NueMD

NueMD is a HIPAA-compliant accounting software offering a comprehensive medical practice management suite. Healthcare providers can use it for scheduling appointments, collecting ePHI, and completing billing tasks. Moreover, NueMD offers advanced-level encryption and BAA signing.

Importance of Using Bookkeeping Software in Healthcare

Healthcare businesses can benefit from using bookkeeping software. First, it makes the payment process for patients quick and easy. Clinics and hospitals can create a more convenient way to develop patient invoices and track employee payroll. It also helps healthcare professionals calculate, file, and pay their taxes efficiently.

Like other businesses, medical organizations spend money on patient services, equipment, medicines, and other supplies. These are part of healthcare revenue cycle management, where bookkeeping and accounting software come into play. Overall, bookkeeping software helps explicitly with invoicing, billing, and recording of expenses. Also, its compliance with HIPAA matters, especially if you intend to use it for tasks involving the handling, processing, and storage of PHI.